Credit Savvy/Commbank

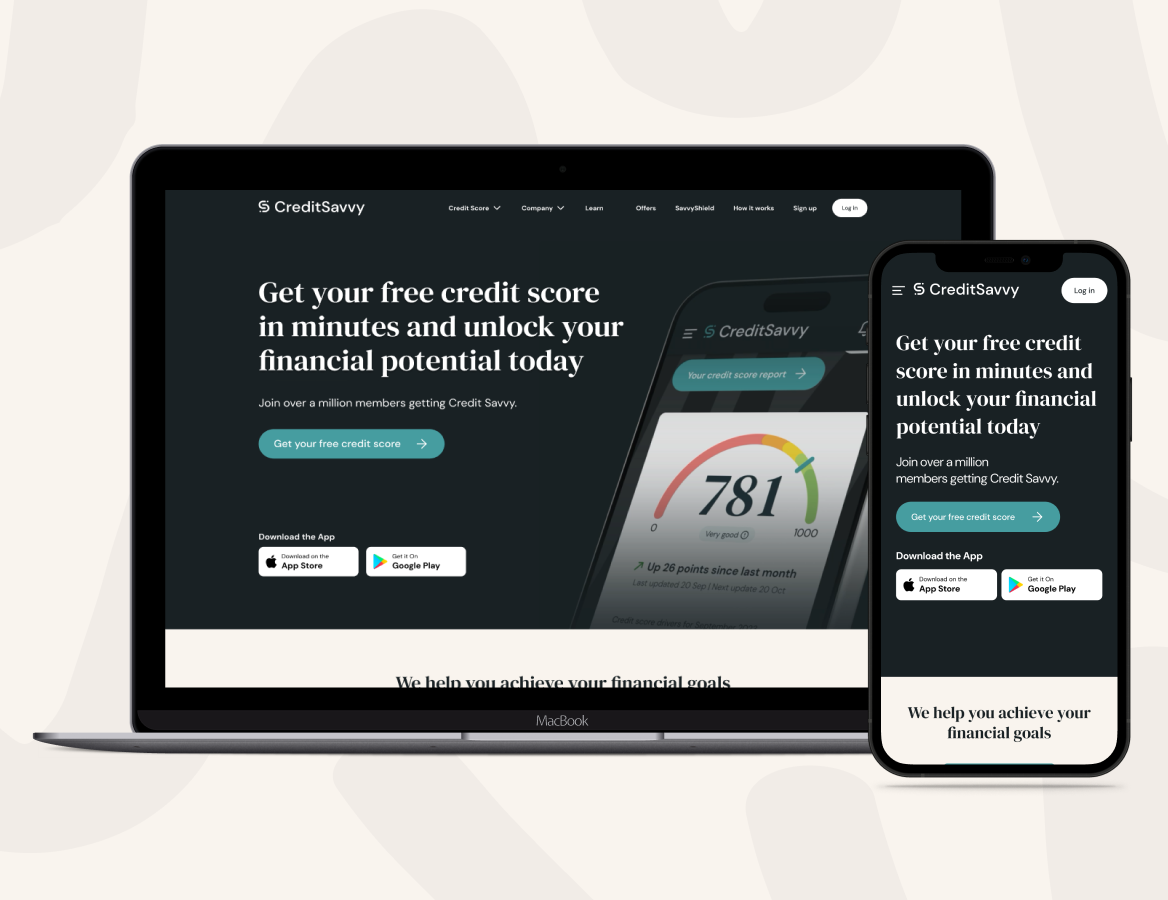

Credit Savvy is an Australian fintech platform that helps users understand, manage and improve their credit health. Through a free credit score report and ongoing monitoring, members can see exactly what factors are affecting their score. The service also compares tailored offers for credit cards, personal loans and home loans based on each user’s profile.

PROJECT

Responsive B2C Website Redesign

DATE

SERVICES

UX Strategy, Wireframing, Prototyping, UI Design, Design Systems

overview

Users were disengaging due to the experience failing to communicate Credit Savvy’s core value proposition, and a patchwork of inconsistent UI patterns with confusing comparison flows across desktop and mobile only amplified the frustration.

We set out to establish a unified design system and craft streamlined user journeys so prospective members could sign up effortlessly and compare credit products with clarity and confidence.

discovery & research

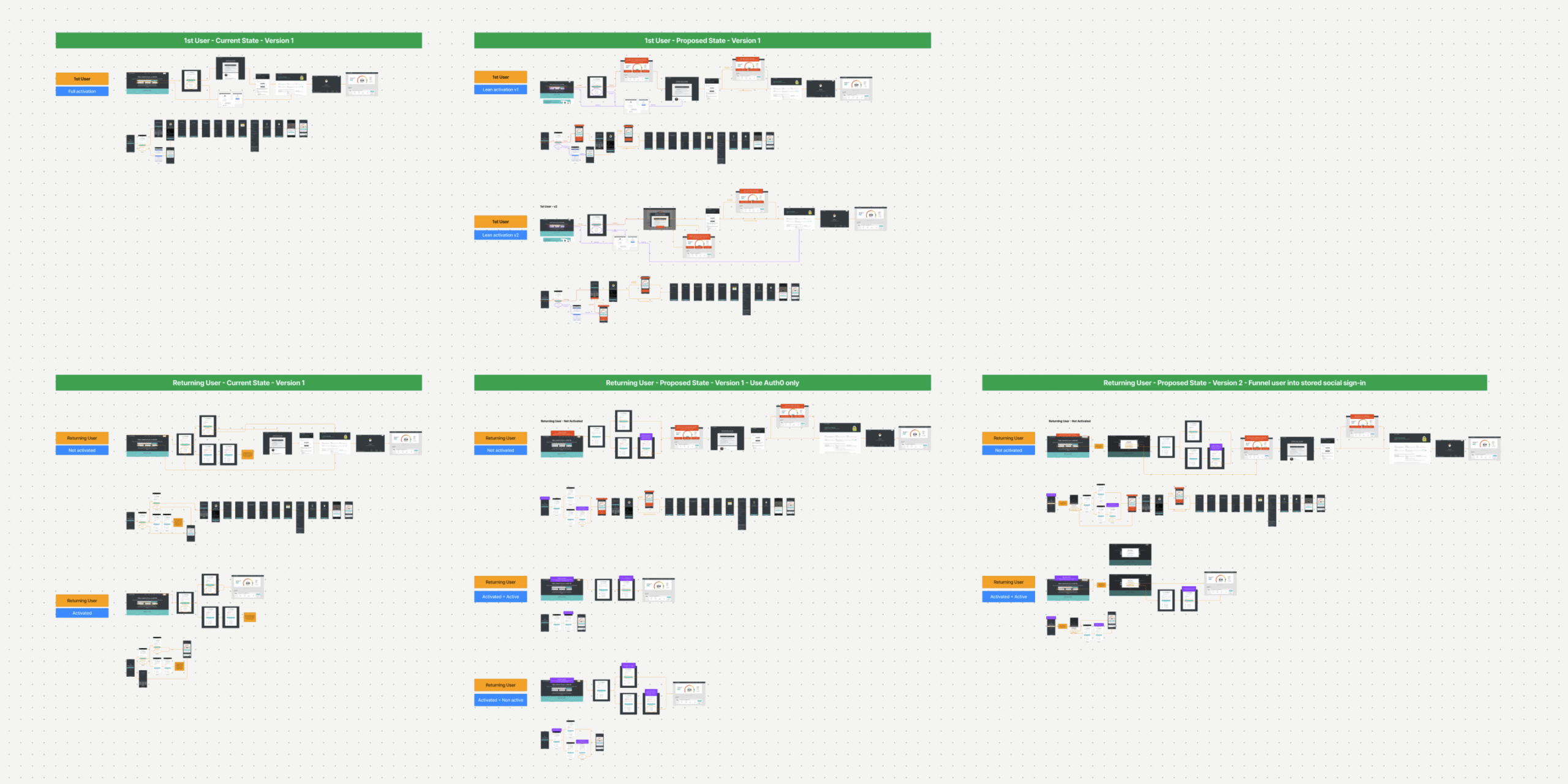

After a detailed review of Hotjar recordings and analytics, along with competitive benchmarking, we identified gaps in mobile usability and outdated component usage. Working closely with the Head of Product and Marketing, we pinpointed key drop-off points in both the product comparison and signup flows.

With those insights, we sketched three layout alternatives for the homepage hero, comparison matrix, and onboarding screens. In collaborative workshops, Product and Engineering aligned on a simplified information architecture and agreed on pattern rules, such as consistent table sorting indicators and standardised form labels, to guide the design system. This shared vision set the stage for pixel-perfect execution.

strategy & ideation

Using insights from research, I defined a modular component strategy that prioritised reusability and accessibility. I sketched three layout alternatives for the homepage hero, comparison matrix, and signup screens, each balancing information density with clear calls to action.

In a series of collaborative workshops, Product and Engineering teams reviewed the sketches, agreed on a simplified information architecture, and established rules for pattern usage, such as consistent table sorting indicators and standardised form labels.

This alignment ensured we had a shared vision before moving into pixel-perfect design.

design & prototyping

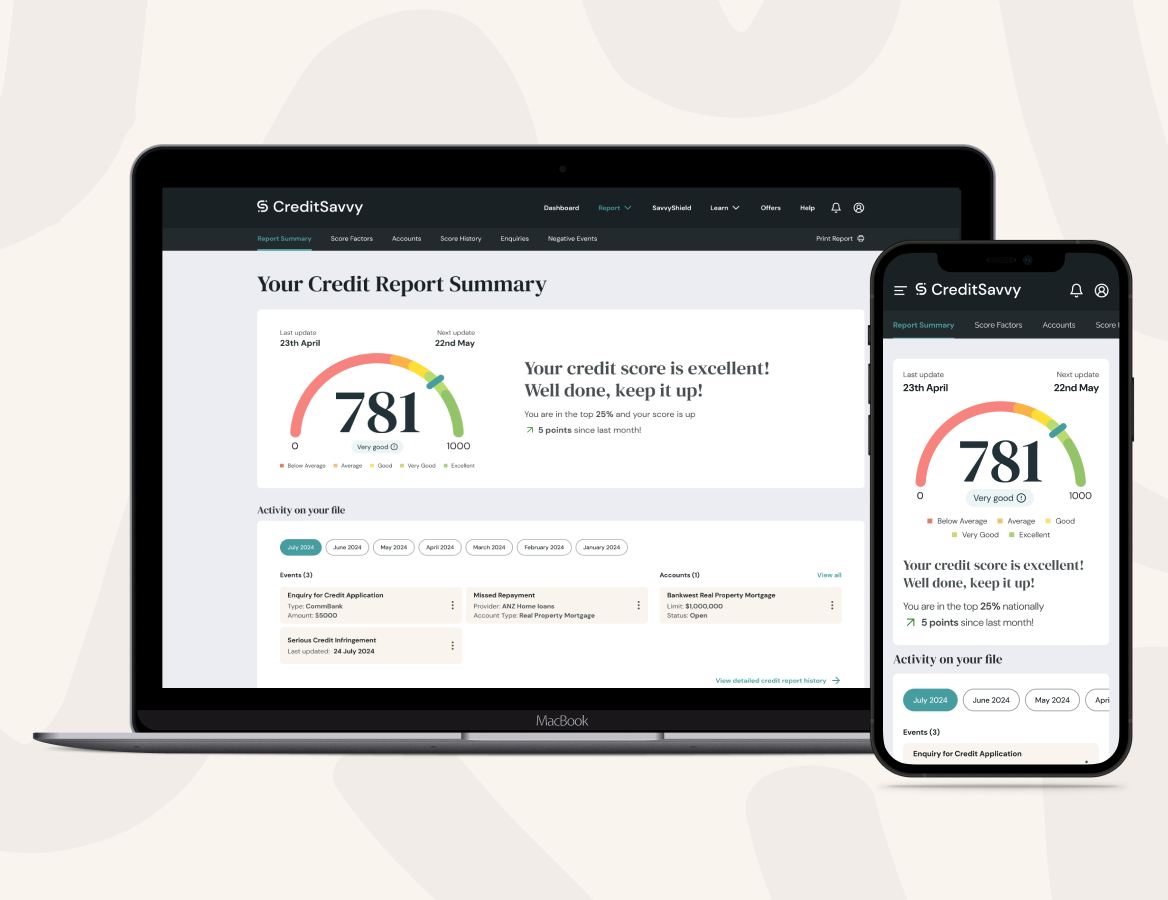

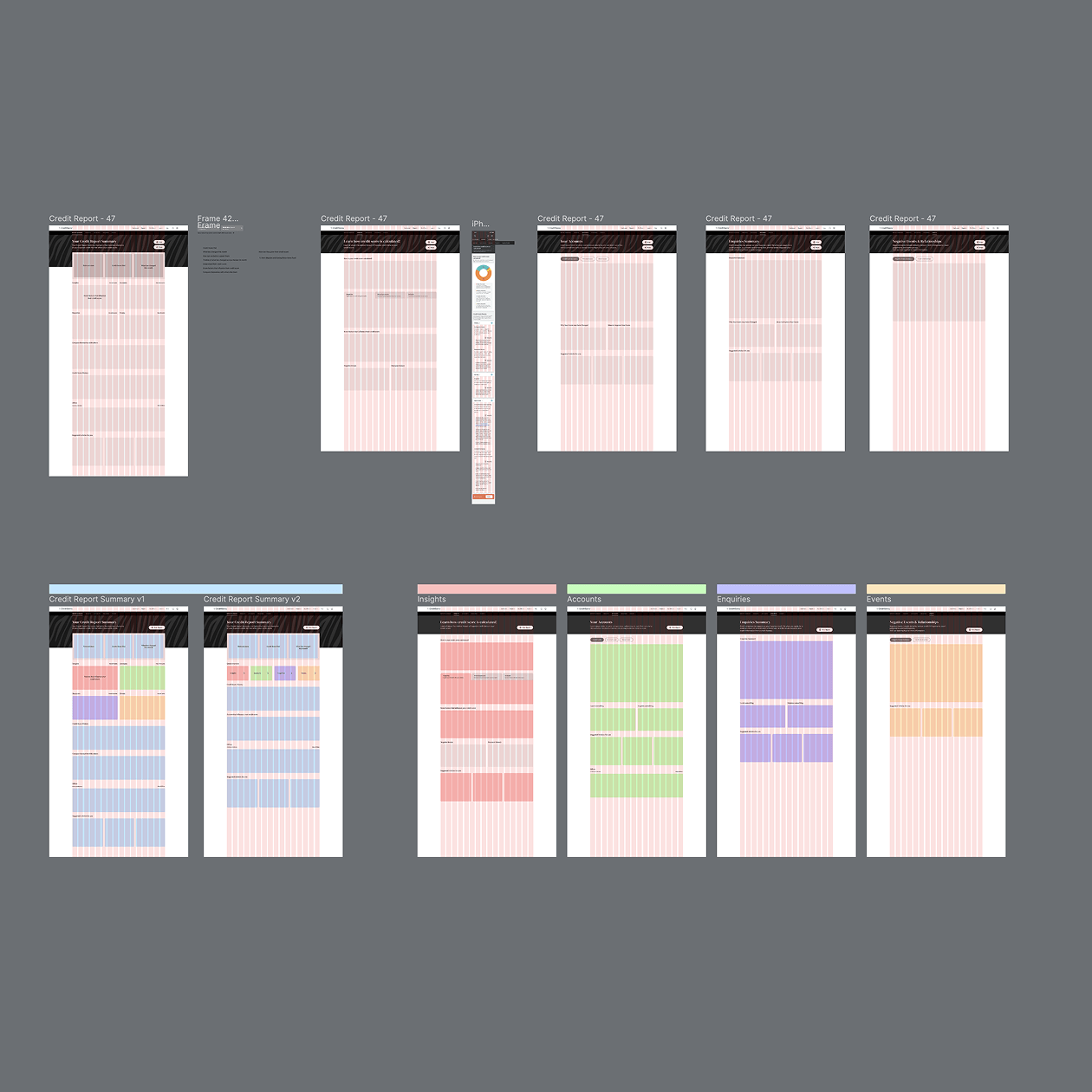

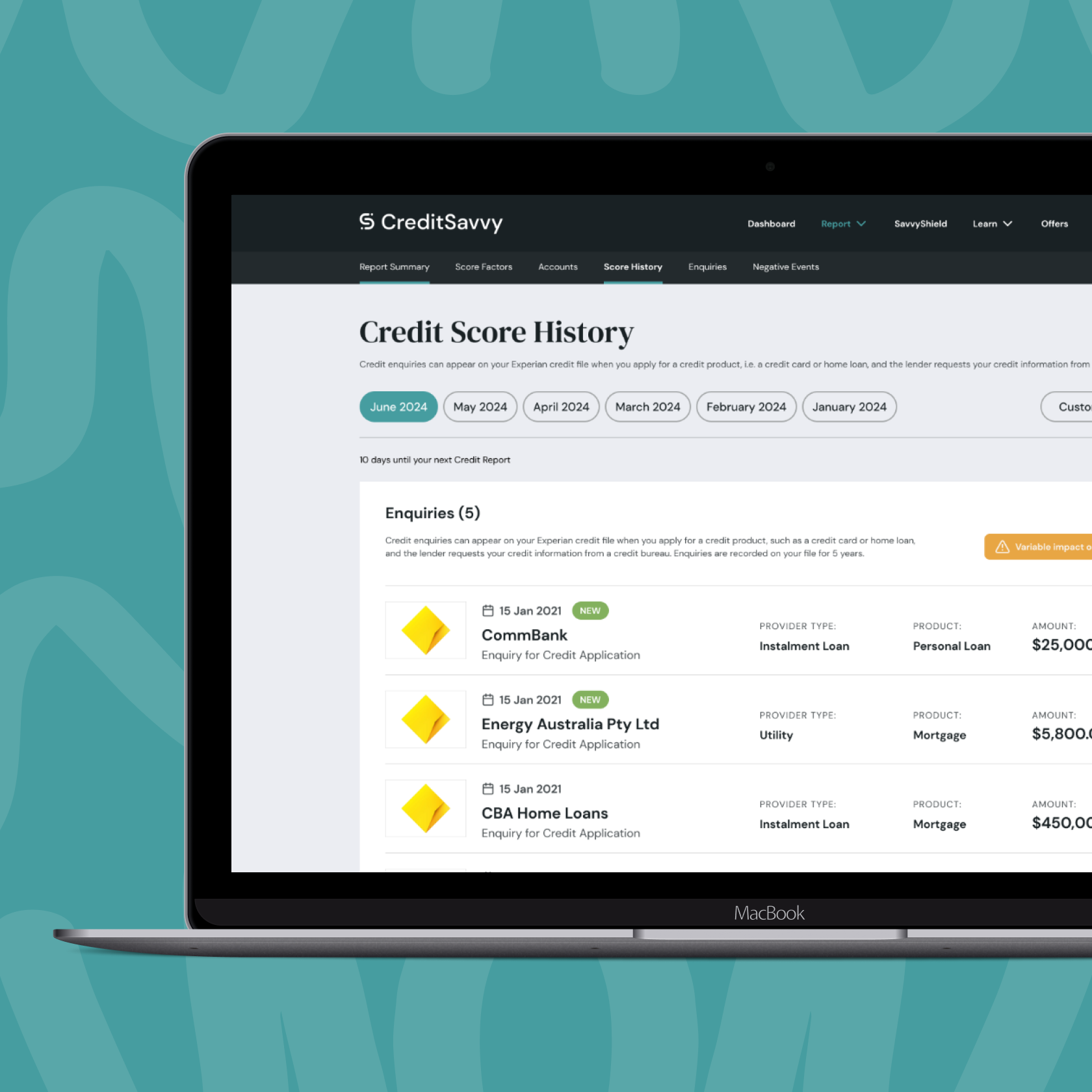

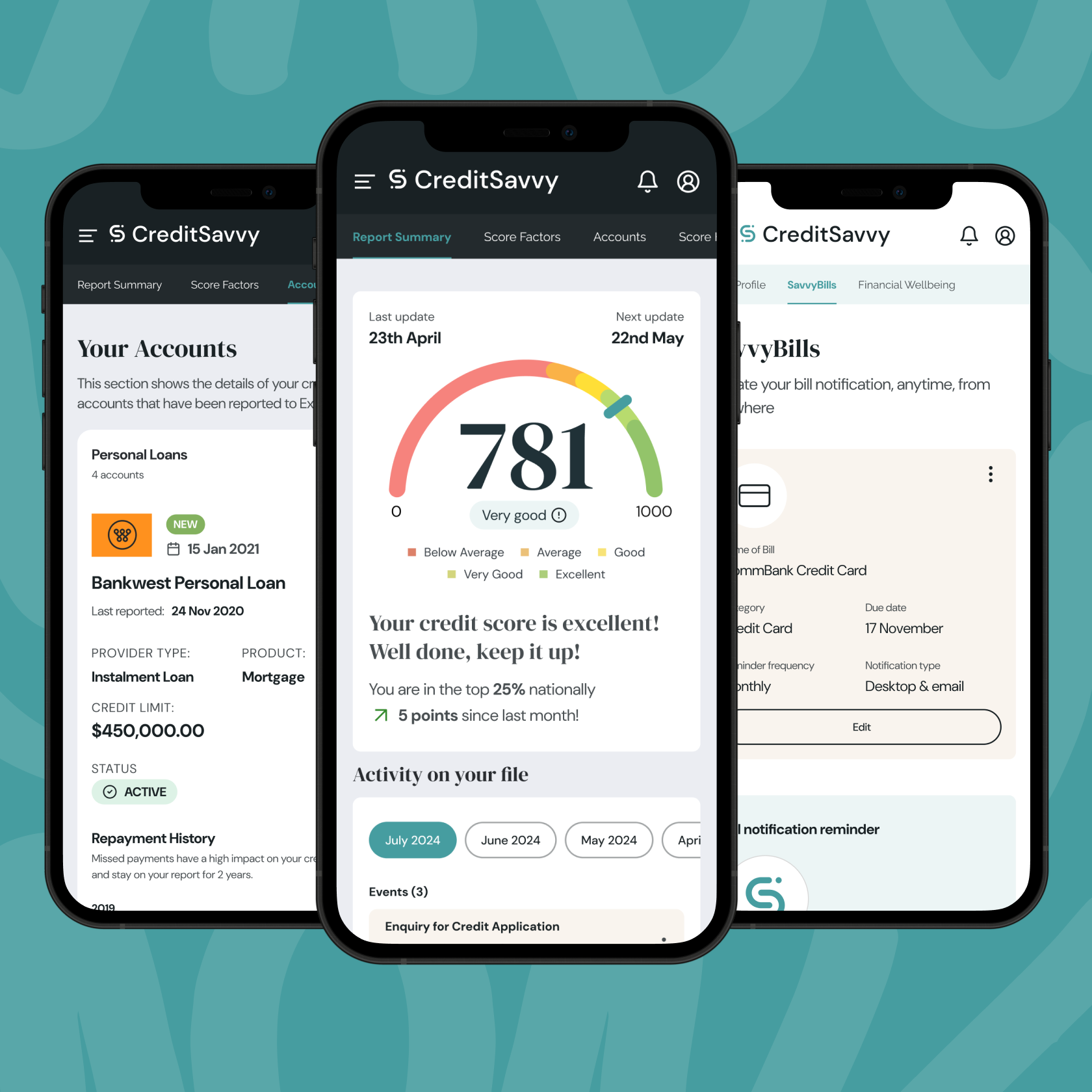

In Figma, I built a responsive design system that included buttons, cards, form elements, data tables, and modals, all with accessible color contrasts and defined auto-layout rules. I created mid-fidelity prototypes to test spacing, typography scales, and mobile breakpoints, and then refined them into high-fidelity mockups for desktop, tablet, and phone.

Interactive prototypes demonstrated dynamic states, hover, focus, error and complex interactions like expanding comparison rows.

responsive web

adaptive layouts at 375, 1024 & 1400 for seamless comparison, signup, and dashboard flows

mobile templates

high-fidelity iOS & Android mockups for credit reports, goals & referrals

component library

figma library of buttons, cards, tables, forms & modals with variants & auto-layout

figma prototypes

clickable flows with smart-animate transitions for tables, expandable rows & validation

dev handoff

annotated specs, redlines & HTML/CSS snippets synced to Jira for pixel-perfect builds

testing & iteration

We ran usability tests with internal stakeholders who completed comparison and signup tasks in a private setting. Observing form errors and task failures, I iterated on call-to-action placement, simplified form validation messages, and added inline guidance for fields

outcome & impact

Clearer flows that boosted user engagement and satisfaction and user retention rose exponentially within a few months.

20%

less drop-offs

redesign improved onboarding drop-offs by 20%

28%

engagement lift

lift in comparison matrix engagement

40%

faster handoff

faster design-to-development handoff

conclusion

The Credit Savvy redesign brought clarity and consistency to a once-fragmented user experience. By unifying the UI with a robust design system, optimising core flows through research-backed iterations, and fostering close collaboration with product and engineering, we delivered a platform that feels intuitive on every device.

The project not only streamlined development handoffs and reduced technical debt but also elevated user engagement, satisfaction, and long-term retention. Moving forward, this foundation will support faster feature rollouts, ongoing usability enhancements, and continued growth for Credit Savvy’s membership base.

LET’S WORK TOGETHER